BECOME A

GLOBAL CITIZEN

Discover the power of a second citizenship.

Live the life you were destined to live through our Citizenship by Investment programmes

[slide-anything id=”4019″]

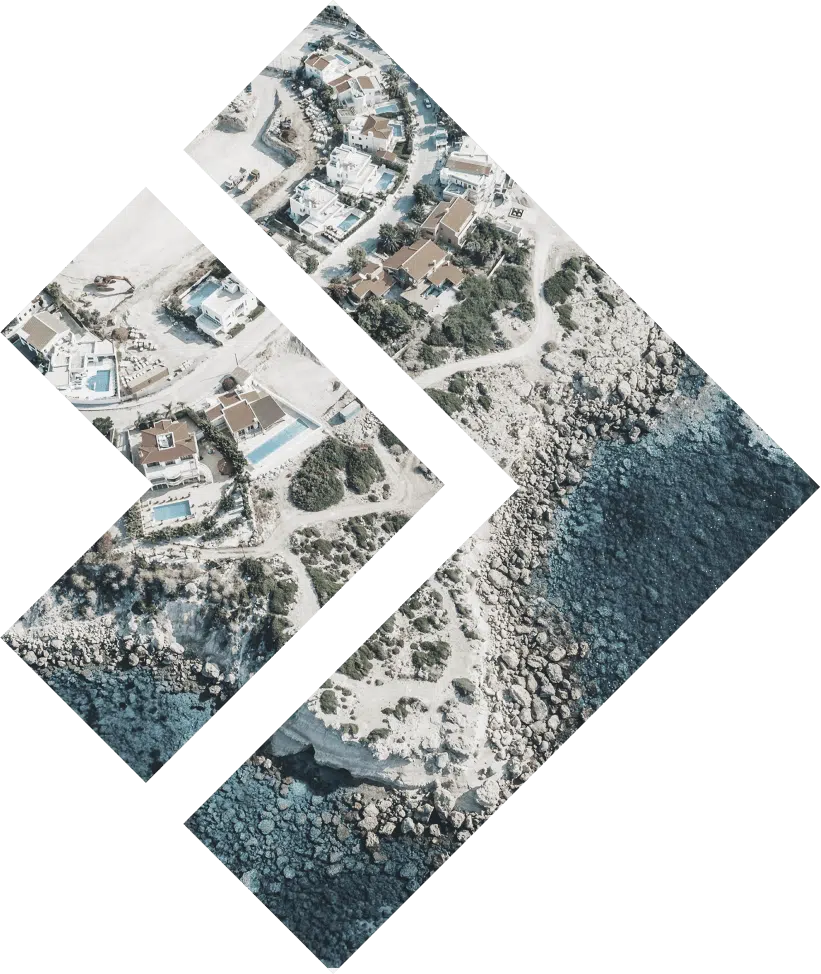

Cyprus Permanent

Residence

Tax incentives and access to the European business market

€300,000+investment

sum3+ monthsregistration

periodEvery two yearsmandatory visit

to the island

Permanent residence in Cyprus can be obtained by investment in real estate or securities worth at least €300,000.

Permanent residence holders may not pay taxes on global income, including dividends and capital gains. The country also has no inheritance tax, low income and property tax rates.

The Cypriot jurisdiction is one of the best places to register the tax residency of an international business or open a new company. This is because the corporate tax rate in the country is only 12.5%.

After 5 years of living on the island, a permanent resident can obtain Cypriot citizenship and travel without visas to 170+ countries, including the European Union and the UK.

Benefits of permanent residence in Cyprus

1. Tax optimizationThere is no tax on global income and inheritance, rates of property and income taxes are low. The corporate tax rate is one of the lowest in Europe — 12.5%.2. Income from investments in real estatePrices on Cypriot real estate grow by 1-4% every year. The same yield is applied to leases of residential property.3. Prospect of obtaining a Cypriot passportPermanent residence is issued for life and is passed on to children. 5 years after receiving permanent residence, its holder can apply for Cypriot citizenship and become a full citizen of the European Union.4. Opportunity to own a businessUnlike many other investment immigration programs, applicants for permanent residence in Cyprus can buy a share in a local business, open their own companies or transfer operating companies to the island’s jurisdiction.5. High quality of lifeCyprus has been included in the list of developed economies by the IMF since 2001. According to the Human Development Index, Cyprus ranks 31st in the world. The island has the lowest crime rate in Europe.

100+ visa-free countries with the Turkish passport

Asia

China

Japan

Singapore

South Korea

+ 12 countries

Africa

Kenya

Madagascar

Seychelles

Tanzania

+ 18 countries

Europe

Ireland

Kosovo

Russia

Oceania

Kiribati

Micronesia

New Caledonia

Niue

+ 10 countries

North America

Bahamas

Barbados

Caymans

Haiti

+ 27 countries

South America

Aruba

Brazil

Colombia

Peru

+ 8 countries

Who is eligible for permanent residence in Cyprus

- Over 18

- Without convictions, sanctions, restrictions or bans on entry the EU countries and the UK

- With an impeccable personal and business reputation

- With an owned or rented accommodation

- With a medical report

- With a legal income of €30,000 per year for the main applicant

- With medical insurance

Spouse

Or a partner

Children under 18

Including children from previous marriages

- Students

- Financially dependent on an investor

- Unmarried

With physical or mental disabilities

Costs for an investor

An investor can choose from several investment options of €300,000: to buy residential or commercial real estate, shares of Cypriot companies or units of local investment funds.

If the applicant has chosen to invest in non-residential property, buying or renting housing on the island will also be necessary. Again, there are no space or cost requirements.

Investments can be returned only after the permanent residence or citizenship expiration.

1 Option Purchase of residential property€300,000+An investor can buy one or two new-built properties with a total value of €300,000 plus VAT. The standard VAT rate is 19%, but if the property is the only housing for investor residing, VAT is reduced to 5%. It is not possible to buy a resale property.

Mckhavens consulting has its database with hundreds of reliable properties, including those at the construction stage, which our clients can buy without a commission. Our lawyers will organize a trip and accompany investors when choosing a property.

Purchase of a residential property

VAT

Legal services

Investor

€300,000+

€15,000+

1% of the transaction amount

Spouses

€300,000+

€15,000+

1% of the transaction amount

Family of 3 or more people

€300,000+

€15,000+

1% of the transaction amount

+ €500 per each additional applicant

Confirmation of income

€30,000+ per year

€35,000+ per year

€40,000 per year

+ €5,000 per each family member starting with the forth one

+ €8,000 per each parent

Due Diligence

€15,000

€25,000

€25,000

+ €10,000 per each family member over 12 years old

Immigration submission fee

€500

€500

€500

+ €500 per each child over 18 and each spouses’ parent

Registration fees

€70+

€140+

€210+

+ €70 per each family member starting with the forth one

Medical insurance

€2,000+ per year

€4,000+ per year

€6,000+ per year

+ €2,000 + per year per each family member starting with the forth one

2 Option Purchase of commercial property€300,000+

An investor can buy one or two commercial properties with a total value of €300,000 plus VAT. The property can be new or secondary. Offices, shops, hotels or a combination worth at least €300,000 qualify as commercial properties under the option.

Purchase of a commercial property

VAT

Legal services

Investor

€300,000+

€57,000+

1% of the transaction amount

Spouses

€300,000+

€57,000+

1% of the transaction amount

Family of 3 or more people

€300,000+

€57,000+

1% of the transaction amount

+ €500 per each additional applicant

Confirmation of income

€30,000+ per year

€35,000+ per year

€40,000 per year

+ €5,000 per each family member starting with the forth one

+ €8,000 per each parent

Due Diligence

€15,000

€25,000

€25,000

+ €10,000 per each family member over 12 years old

Immigration submission fee

€500

€500

€500

+ €500 per each child over 18 and each spouses’ parent

Registration fees

€70+

€140+

€210+

+ €70 per each family member starting with the forth one

Medical insurance

€2,000+ per year

€4,000+ per year

€6,000+ per year

+ €2,000 + per year per each family member starting with the forth one

3 Option Shares of Cypriot companies€300,000+Equity investment in a Cypriot company that conducts business and employs at least 5 people in Cyprus.4 Option Purchase of securities€300,000+Investments in units of Cyprus investment funds in the form of AIF, AIFLNP, RAIF.

Investment option:

1. shares of Cypriot companies;

2. units of Cypriot investment funds

Investor

€300,000+

Spouses

€300,000+

Family of 3 or more people

€300,000+

Confirmation of income

€30,000+ per year

€35,000+ per year

€40,000 per year

+ €5,000 per each family member starting with the forth one

+ €8,000 per each parent

Due Diligence

€15,000

€25,000

€25,000

+ €10,000 per each family member over 12 years old

Immigration submission fee

€500

€500

€500

+ €500 per each child over 18 and each spouses’ parent

Registration fees

€70+

€140+

€210+

+ €70 per each family member starting with the forth one

Medical insurance

€2,000+ per year

€4,000+ per year

€6,000+ per year

+ €2,000 + per year per each family member starting with the forth one

Costs for a family of three

An investor with their spouse and a child

Purchase of a residential property

Purchase of commercial property

Investments in securities

Investment

€300,000+

€300,000+

€300,000+

VAT

€15,000+

€57,000

_

Confirmation of income

€40,000 per year

€40,000 per year

€40,000 per year

Due Diligence

€25,000

€25,000

€25,000

Immigration submission fee

€500

€500

€500

Registration fees

€210

€210

€210

Fee for a permanent residence card

€7,000

€7,000

€7,000

Medical insurance

€6,000+ per year

€6,000+ per year

€6,000+ per year

Step-by-step procedure for obtaining permanent residence in Cyprus

Obtaining permanent residence in Cyprus by investment takes about two months. Everything can be done remotely, so it is not necessary to fly to the island. The applicant will only need to collect documents and select an investment object.

1. Preliminary Due Diligence

2. Collection of documents

1. Preliminary Due Diligence

Due Diligence is a mandatory step in any residency program for investors. Its results define whether the investor becomes a resident of the country.

To increase the chances of approval, Mckhavens consulting conducts own preliminary Due Diligence.

A certified Anti Money Laundering Officer checks the investor’s documents and searches for information about him in international databases. If there is a problem, we suggest a solution, such as attaching an affidavit to the application or choosing a different program.

The check is confidential and takes only one business day. Thanks to it, the risk of rejection is reduced to 1%.

2. Collection of documents

We help collect, translate and apostille documents, get medical insurance and conclude a real estate lease agreement.

We hand the documents over to our agent in Cyprus when everything is ready.

Main set of documents includes:

- A completed MIP1 application form.

- Originals and copies of valid passports of all the applicants.

- A main applicant’s biography.

- A declaration confirming an annual income of at least €30,000.

- A confirmation of investment.

- Proof of a permanent address in Cyprus.

- A statement on the absence of employment in Cyprus.

- A certificate of no criminal record for the main applicant and their spouse.

- A marriage certificate.

- A birth certificate.

- Medical insurance for the whole family.

3. Fulfillment of investment conditions

4. Application to the Cyprus Migration Service

3. Fulfillment of investment conditions

When buying a property, we submit documents to the Cyprus Department of Lands and Surveys of Cyprus, including an application to reduce the VAT rate to 5%. The investor transfers €200,000 and VAT to the developer.

We have our own database of properties, including those under construction. We will help you decide on the type of investment or choose a property, draw up a contract of sale and conduct a deal.

4. Application to the Cyprus Migration Service

The applicant does not have to fly to the island as our agent in Cyprus can submit all the documents.

5. Application processing and obtaining permanent residence

5. Application processing and obtaining permanent residence

The decision to grant permanent residence is made within two months. Within a year after the approval, the investor and their family must visit the island to submit biometric data and obtain permanent residence.

Additional services after obtaining permanent residence in Cyprus

Everyday life issues will remain after obtaining permanent residence in Cyprus as the investor will have to communicate with banks, the migration service and other officials. We will help to get the necessary documents and make everything go smoothly.

1. Renewing permanent residence cards

2. Opening a bank account

1. Renewing permanent residence cards

We collect and submit the necessary documents and take over communication with officials.

2. Opening a bank account

We help to choose a bank and prepare documents for opening an account.

7. Managing property

7. Managing property

We conclude a contract for the management of the real estate. We undertake the preparation of housing, the search for tenants, the conclusion of an agreement, rent and taxes.

3. Choosing real estate

4. Application to the Cyprus Migration Service

3. Choosing real estate

We have our database of properties, and we work directly with Cypriot developers, so you do not have to pay a commission. We help choose a region, type of real estate and suitable property, including at the construction stage. We accompany you when selecting a property and making a deal.

4. Application to the Cyprus Migration Service

The applicant does not have to fly to the island as our agent in Cyprus can submit all the documents.

5.Registering tax residence

6. Obtaining permanent residence for family reunification

5.Registering tax residence

We request a tax resident status to the tax office after a standard stay in the country for more than 183 days a year or after 60 days for property owners who run a Cypriot company.

6. Obtaining permanent residence for family reunification

We prepare the documents and apply if you want your parents or close relatives to move to Cyprus.

Answers to frequently asked questions

Are investments for permanent residence in Cyprus returnable?

Yes, all investments can be returned after the expiration of the permanent residence or citizenship. If you sell securities before this time, the status will be cancelled. If an investor sells real estate, he is obliged to buy another property for the same or higher price.

What is the minimum investment amount?

The minimum investment amount is €300,000. The investor also needs to open a bank deposit of €30,000 per person, undergo Due Diligence with a fee from €15,000, pay administrative and registration fees of €570 per person, as well as the fee for a permanent residence card of €5,000 and get medical insurance. If the applicant has chosen to invest in non-residential property, then it will also be necessary to buy or rent a property on the island.

How to get Cypriot citizenship?

The citizenship by investment program is suspended in Cyprus. Previously, an investor could get a country’s passport by investing 2 million euros.

The owner of the permanent residence in Cyprus can become a citizen of the country after having lived on the island for at least 5 years. Additionally, they will need to confirm knowledge of the language and culture of Cyprus, as well as pass an interview at the migration service.

What obligations arise after obtaining permanent residence in Cyprus?

It is mandatory to visit the country within a year after the approval of permanent residence — to submit biometric data and receive a permanent residence card. After that, it is enough to visit the island once every two years, keep investments, and also have an income of €30,000 per person per year.

What taxes do holders of permanent residence in Cyprus pay?

A permanent resident without tax residency may not pay tax on global income, including the one from investments: taxes must be paid only on profits earned on the island.

Tax residents must pay income tax on all their income and other types of taxes. The income tax rate depends on the income amount, e.g. up to €28,000 per year are taxable under 20%, and €60,000 per year — is under 35%.

It is not necessary to become a tax resident, even if you live in the country for more than 183 days a year.

Schedule a meeting

Let’s discuss the details

Do you prefer messengers?

Matthew Oke Havens

Senior Consultant & Partner (Africa)