BECOME A

GLOBAL CITIZEN

Discover the power of a second citizenship.

Live the life you were destined to live through our Citizenship by Investment programmes

[slide-anything id=”4019″]

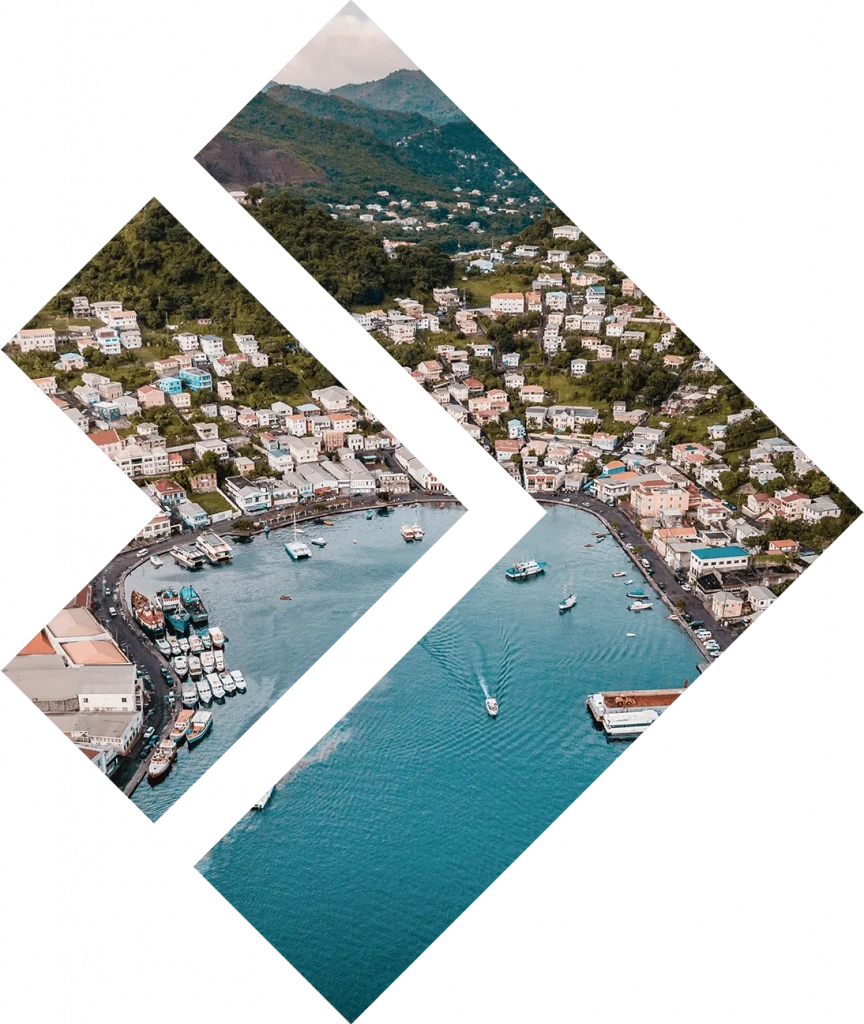

Grenada

Citizenship

Visa-free travel to 144 countries

and the E-2 business visa to the USA

$150,000Investment amount4–6 monthsObtaining period5 yearsReal estate

investment return

The Grenada citizenship by investment program was launched in 2013. The program rules are provided in the Grenada Citizenship by Investment Act No. 15/2013.

Investors contribute $150,000 to the state fund or buy real estate for at least $220,000 to obtain Grenada citizenship. Real estate investments can be returned in 5 years.

Investors don’t take language proficiency tests or history exams to get citizenship. They don’t have to come to Grenada at any step of obtaining citizenship or after it.

An investor’s spouse, children, parents and siblings can get passports under the program.

Benefits of Grenada citizenship

1. Visa-free travel to the UK, the Schengen countries and China

Grenada citizens enter 144 countries without visas, including the UK, the Schengen states, Singapore and Hong Kong. A visa-free stay in China is up to 30 days.

2. E-2 business visa to the USA

Grenada citizens can qualify for an E-2 visa to the USA, which allows them to live and work in the country. Applicants establish or buy a business in the United States. The minimum investment amount isn’t, but at least $100,000 is usually required. Most foreigners can apply only for an EB-5 visa, which requires at least $800,000 of business investment

3. 10-year US tourist visasCosmopolitans with the Grenada passport can get a B-1/B-2 tourist visa to the USA. It allows the holder to travel around the country, attend business meetings and get medical treatment in American clinics for up to 180 days a year.4. Registration of a company abroadInvestors often register international companies in Grenada to reduce tax payments and avoid currency control restrictions in transactions with foreign partners. Moreover, it helps protect the investor’s privacy as the personal data of the beneficial owner isn’t entered into the commercial register. 5. Tax optimization

Grenada doesn’t have taxes on global income, dividends, interest or royalties received from other countries. There are no taxes on inheritance, capital gains, income and stamp duty. Companies follow different rules, but they are still more beneficial in Dominica than in many other countries.

140+ visa-free countries for Grenada citizens

Asia

Hong Kong

China

Malaysia

Singapore

Sri Lanka

+16 countries

Africa

Zambia

Cape Verde

Kenya

Seychelles

Tanzania

+21 countries

Europe

Austria

Belgium

United Kingdom

Germany

France

+40 countries

Oceania

New Caledonia

Cook Islands

Solomon Islands

Fiji

French Polynesia

+7 countries

North America

Barbados

Bermuda

Cayman Islands

Costa Rica

Jamaica

+20 countries

South America

Argentina

Bolivia

Brazil

Colombia

Peru

+10 countries

Who can get Grenada citizenship

- Over 18 years old

- No criminal record or prosecution

- Good health

- Capable of confirming the legality of the income

Fully financially dependent on the investor or their spouse

Fully financially dependent on the investor

- Over 18

- Unmarried

- No children

Investment options for Grenada citizenship

Grenada offers applicants two options: a non-refundable contribution to the Sustainable Development Fund and a real estate purchase.

1Option Non-refundable contribution

$150,000+

Applicants who choose to contribute to the National Transformation Fund should note that it is non-refundable.

Investor

Married Couple

Family of 4, excluding siblings

Family of 5, or more people

Contribution to the fund

$150,000

$200,000

$200,000

|

$200,000 + $25,000 per + $50,000 + $75,000 per |

Due Diligence

$5,000

$10,000

$5,000 per family

member over 17

$5,000 per family

member over 17

Other fees

$3,270

$6,540

$11,080+

$15,620+

2Option Real estate purchase

$220,000+

Investors buy shares in state-approved projects. The investor can sell the property in 5 years and return a part of the money spent on citizenship.

Purchase of real estate

State fee

Investor

$220,000

$50,000

Married Couple

$220,000

$50,000

Family of 4

$220,000

$50,000

Family of 5 or more

$220,000

$50,000

+ $25,000 per

parent over 55 or

child starting with

the fifth family

member

+ $50,000 per

parent under 55

+ $75,000 per

sibling

Due Diligence

Other fees

$5,000

$3,270

$10,000

$6,540

$5,000 per family member over 17

$11,080 +

$5,000 per family member over 17

$15,620 +

Expenses for a family of 4

The spouses and two children of 7 and 19 years old

Contribution to the State fund

Purchase of social real estate

Investment

$200,000

$220,000

State Fee

_

$50,000

Due Diligence

$15,000

$15,000

Other Fees

$12,080

$12,080

Total

$227,080

$297,080

Why do applicant’s need a licensed agent’s help?

The Grenada law prohibits investors from applying for citizenship by investment on their own. The applicant must contact a licensed agent to participate in the Grenada citizenship by investment program. The licensed agent is a consulting company that assists applicants at every stage of obtaining citizenship.

Step-by-step procedure for obtaining Grenada citizenship

The stages of obtaining the St Kitts and Nevis passport are similar for both investment options, namely a contribution to the state fund and the real estate purchase.

Preliminary Due Diligence

Preparation of Document

Preliminary Due Diligence

Mckhavens consulting has its own Compliance Department. Certified Anti Money Laundering Officers check investors’ documents. They are familiar with the nuances of Due Diligence in different countries and search for risks in the applicant’s personal or business background that may lead to rejection in obtaining Grenada citizenship.

The preliminary Due Diligence check reduces the rejection risk to 1%. The check is confidential. The investor needs to provide only their passport.

Pass a quick test and learn the nuances that can prevent you from obtaining a second citizenship

Preparation of Document

Mckhavens consulting lawyers draw up a list of required documents based on the program requirements and preliminary Due Diligence results. The list includes personal documents and financial records, including passports, certificates and bank statements.

The lawyers notarize the copies, fill out the required forms, and draw written statements or affidavits. They send the prepared documents to the Grenada CBI unit.

Due Diligence

Approval and fulfilment of the investment condition

Due Diligence

The Grenada CBI unit begins the Due Diligence check after receiving the required documents. The check takes 3 to 6 months.

Sometimes, questions may arise during Due Diligence. For example, the CBI unit may ask for additional documents or explanations. Mckhavens consulting lawyers deals with these requests.

Approval and fulfilment of the investment condition

The CBI unit informs Mckhavens consulting when the application is approved. Once the notification is received, the investor must fulfil the investment condition: contribute to the state fund or purchase real estate. The investment must be made within 30 days.

Getting a passport

Getting a passport

A passport and a naturalization certificate are issued within 4 weeks after fulfilling the investment condition. The investor receives the documents by courier at a convenient address.

Answers to frequently asked questions

Who can obtain Grenada citizenship together with the investor?

The investor’s spouse, children under 30, siblings over 18, and parents of any age are eligible to participate in the program. Except for the spouse, all adult family members must be financially dependent on the investor.

The family composition affects the cost. For example, a married couple with two children contributes $200,000 to the state fund, while a couple with three children and a 60-year-old grandmother contributes $250,000.

The investment can be returned only in a case of real estate purchase. The contribution to the state fund is non-refundable.

An investor can sell the property in 5 years. The investor makes 2-5% per annum as rental income during the ownership period.

The investor can only buy government-approved properties which usually, are five star hotels. The government of Grenada monitors the developers to ensure that they complete the construction on time.

Can I apply for Grenada citizenship without a licensed agent?

No, you can’t. The participation of a licensed agent is required by law. Only a licensed agent can apply to participate in the Grenada CBI program on the investor’s behalf.

Which family members must undergo Due Diligence?

Due Diligence is mandatory for all family members over 17 included in the application.

What are the additional costs under the program?

The applicant pays government fees, costs for legal services and document shipping.

The government fees include:

- $5,000 — the Due Diligence fee per family member over 17;

- $1,500 — the application fee per family member;

- $1,500 — the application processing fee per family member over 18;

- $500 — the application processing fee per family member under 18;

- $250 — the passport fee per applicant;

- $20 — the oath fee per applicant.

The total cost of participating in the Grenada CBI program depends on the number of family members included in the application and their specific situation. The costs are calculated individually.

Schedule a meeting

Let’s discuss the details

Do you prefer messengers?

Matthew Oke Havens

Senior Consultant & Partner (Africa)